Don't miss the chance to try it FREE today.

The world will begin to wean itself off its reliance on oil starting in about 20 more years. According to Bernstein analyst Neil Beveridge, the world will hit peak oil in 2035.

The global crude oil supply glut, as well as the rise of electric vehicles, slowing growth in China and increases in fuel efficiency have some investors turning permanently bearish on oil. However, Beveridge believes oil demand could soon begin heading in the opposite direction.

“Despite these uncertainties, a key conclusion from our analysis is that demand growth through 2020 could well be stronger than the previous decade with growth of 1.4% CAGR,” Beveridge explains.

While Beveridge acknowledges peak oil demand will likely hit up to five years before peak supply, both events are far enough into the future that they are insignificant compared to the near-term opportunities for oil investors.

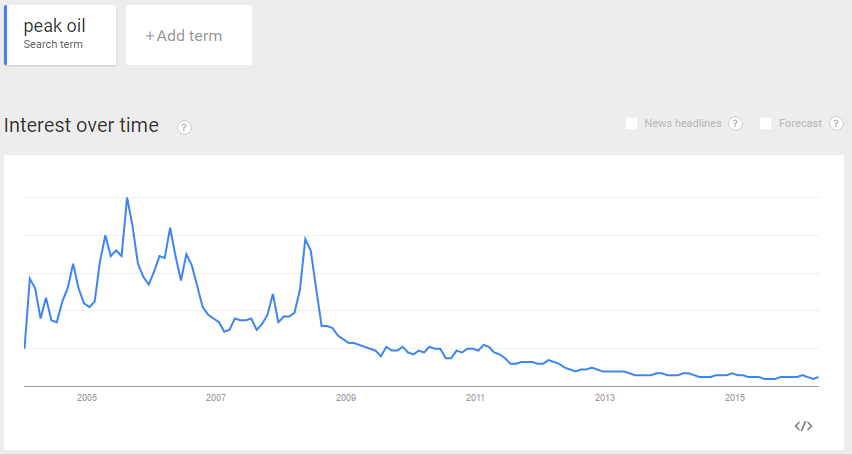

“Peak oil” was once a hot topic on Wall Street during the days of the oil boom, but Google Trends data indicates the idea is no longer on the public’s radar.

So far in 2016, the United States Oil Fund LP USO 0.37% is down another 4.9 percent.

Bernstein sees North American E&P stocks as the biggest beneficiaries to rising oil prices in the next several years and names ConocoPhillips COP 3.01%, EOG Resources Inc EOG 2.22% and Devon Energy Corp DVN 3.74% among its top Outperform-rated oil picks.

Disclosure: the author holds no position in the stocks mentioned.

Posted-In: BernsteinAnalyst Color Specialty ETFs Commodities Top Stories Markets Analyst Ratings ETFs Best of Benzinga

© 2016 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.