|

|

|

|

|

EnergyInsights.net team

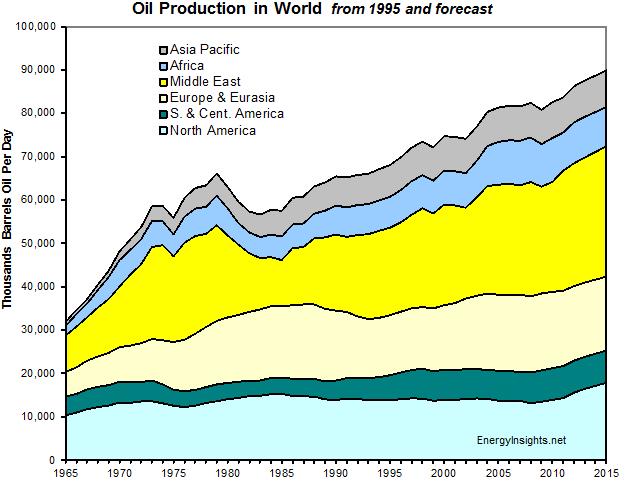

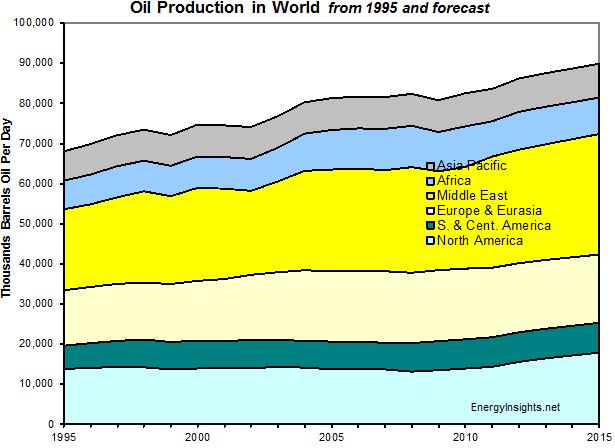

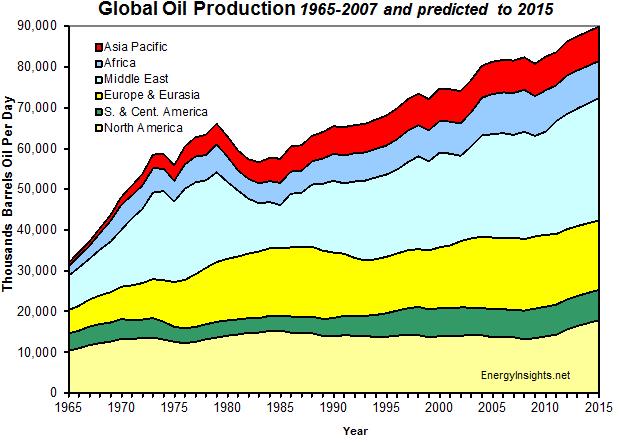

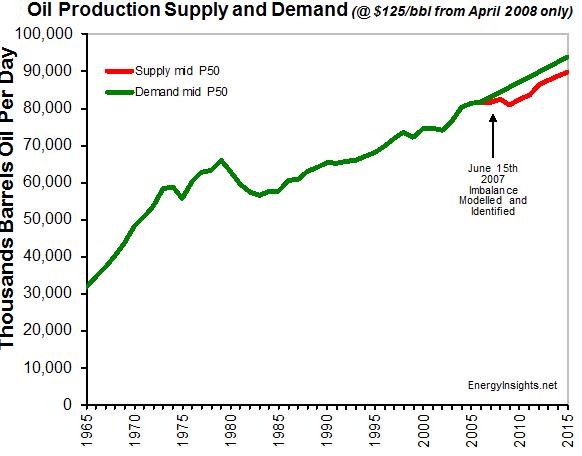

Enclosed are some interesting insights into the world of oil production and consumption from June 2013 data (BP statistics). We have highlights some key themes below the charts to help guide your eyes.

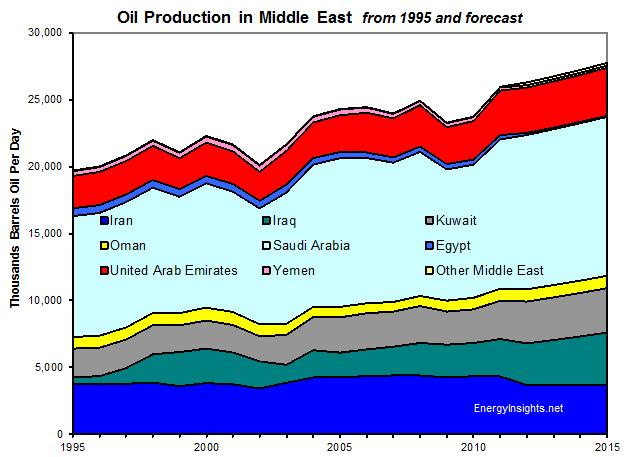

Middle East oil production continues to rise at a fairly slow pace - increased in Saudi Arabia, Kuwait and Iraq offsetting declines in other countries. Increased in Iraq have been disappointing. Oil consumption in Saudi Arabia continues to increase, hence exports are not that strong.

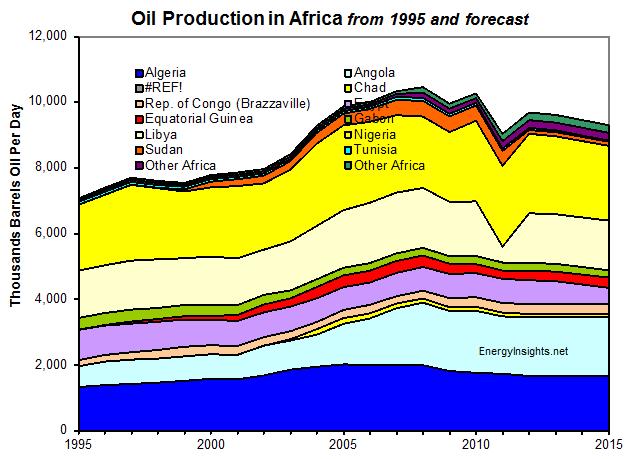

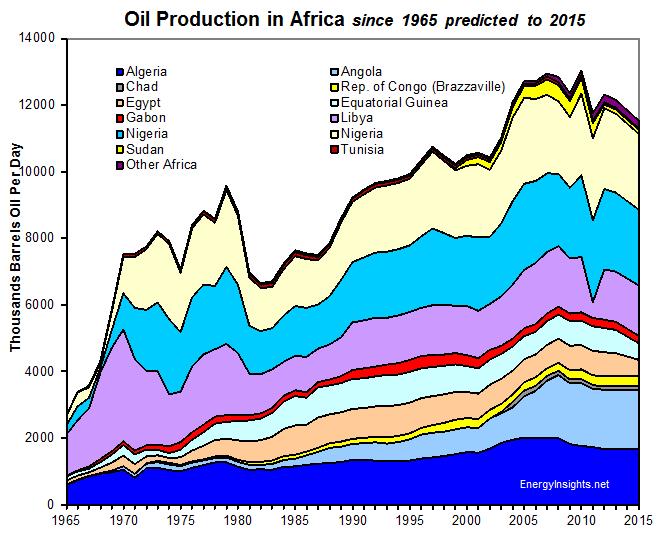

African oil production appears to be in a long term decline - despite recent discoveries in East and West Africa. Major losses have occurred in Nigeria over the years - Egyptian oil production has collapsed.

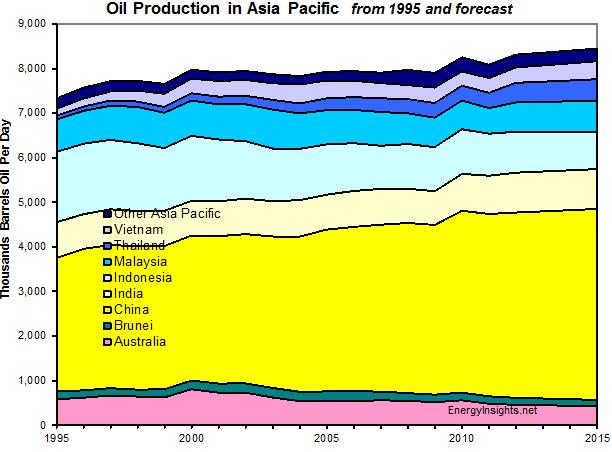

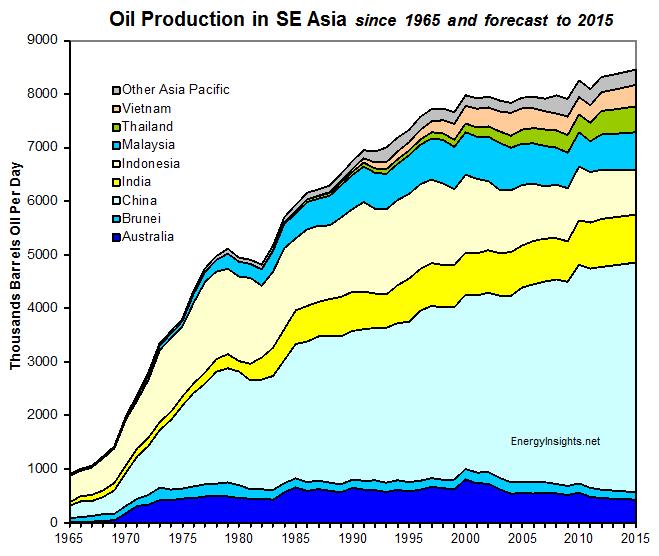

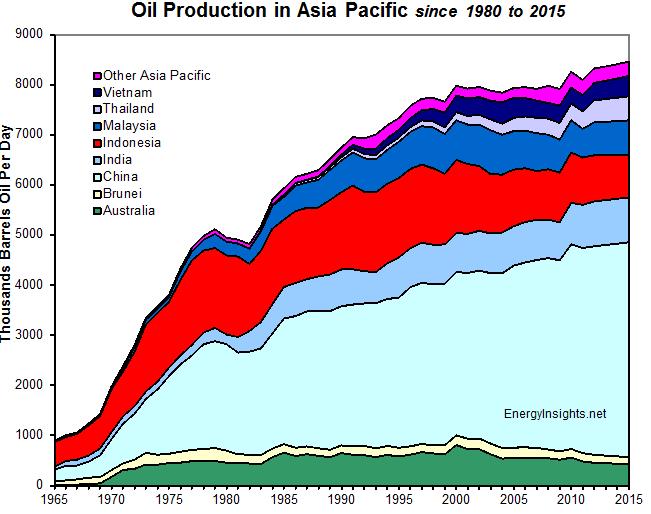

SE Asian oil production continues to increase slightly - though within this range of countries, Indonesia has suffered large declines, Australia is declining whilst China manages slight increases.

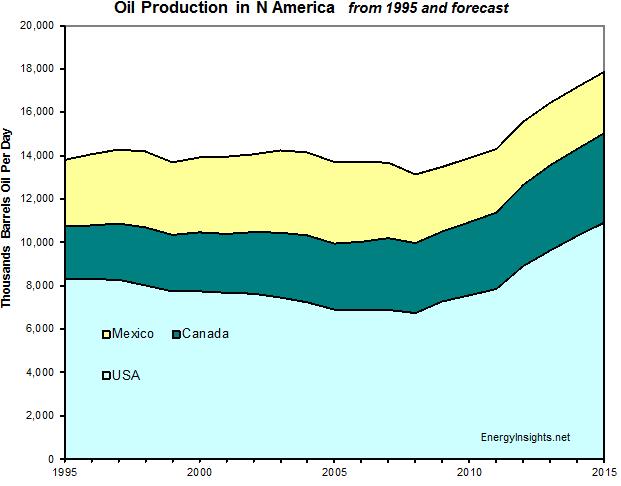

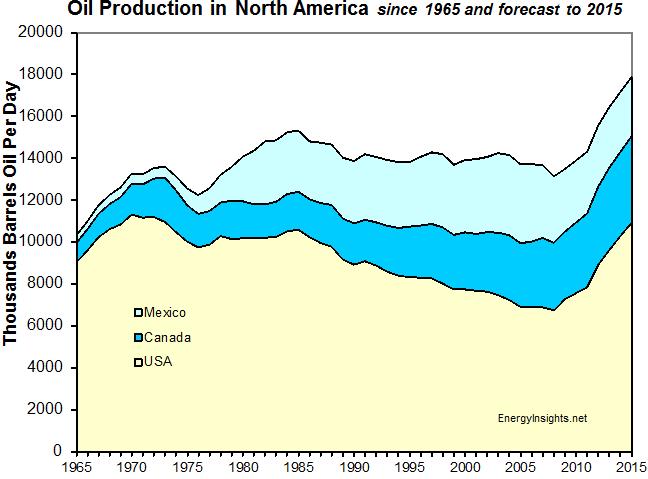

US oil production is booming! No doubt about it - a gigantic turnaround no-one foresaw back in 2004. It started with shale-gas, then the gas price collapsed in 2008 from $12/mmbtu to 2.5/mmbtu - then the innovative oil men of the USA switched tact and went for the oil rich shale rocks of the Bakken Formation in North Dakota and Eagle Ford of Texas - plus others. This has transformed the energy landscape in the USA and likely saved the country in 2010-2013 from another economic meltdown. Hat's off the ingenuity of the US oil men once more. After successes in 1910 in Texas, 1970 in Alaska, 1980 in the Gulf of Mexico - when all looks bleak - they found massive new reserves in shale deposits onshore in Texas and Dakota heartlands.

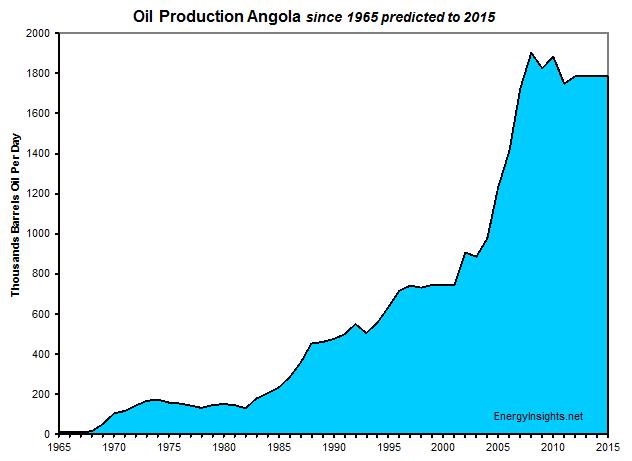

Angola oil production rocketed - and has now plateaued.

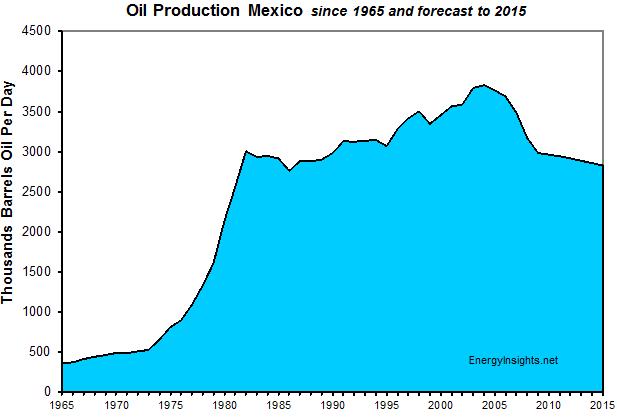

Mexican oil production collapses - and has now started to stabilize somewhat.

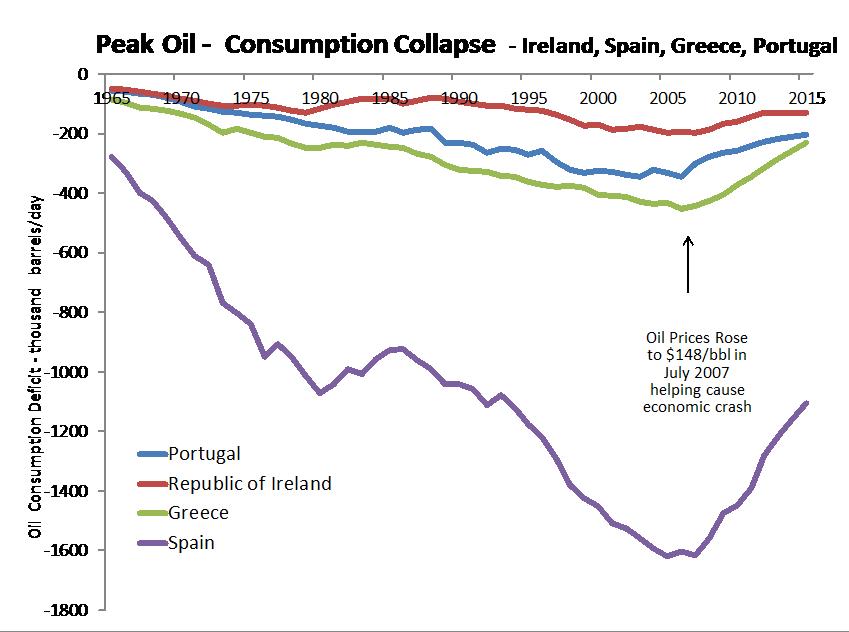

The PIGS countries have seen their oil consumption collapse along with their economies - not a good sign.

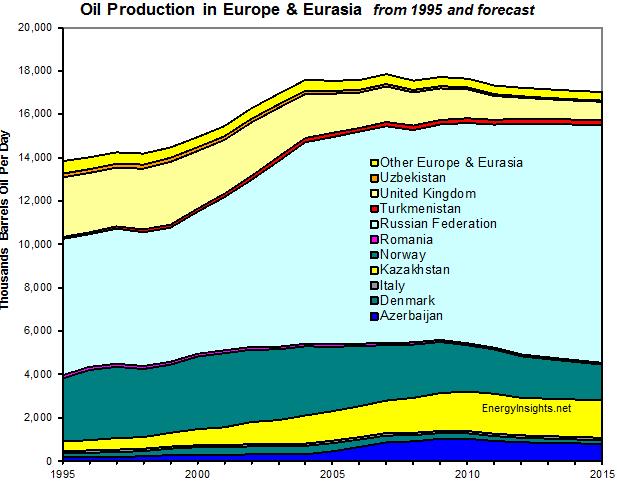

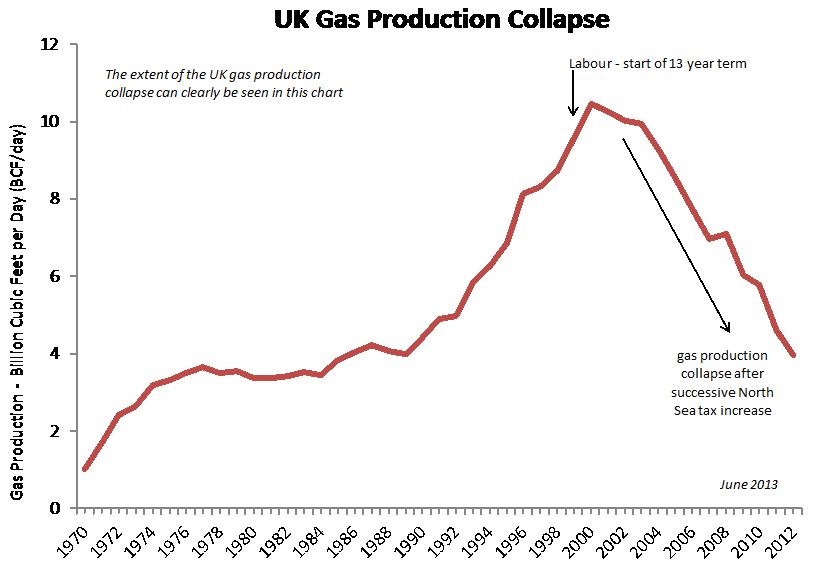

Gas production in the UK has collapsed after successive tax increases and lack of investment. Shale gas have yet to be tested - no flow from any shale gas well has ever been recorded - so the countries has still no idea whether this is economic if planning allowed its development (something we think rather unlikely in the next 5 years). Gas prices have come under immense pressure as gas production has collapse - due to high prices foreign imports. Tax breaks for gas have not been forthcoming.

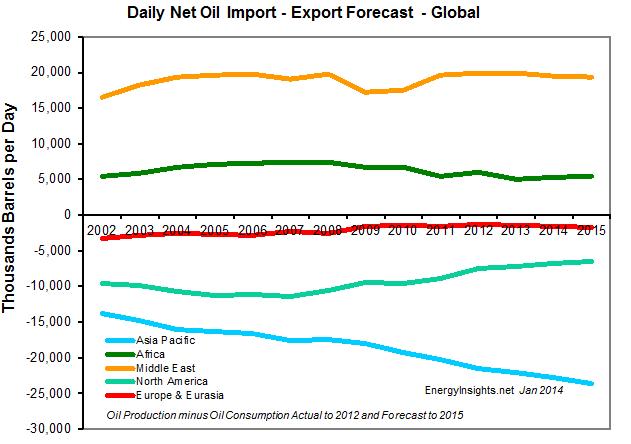

Global oil production continues to rise - but the new oil coming onstream has exploration and development costs of range $15-$80/bbl (oil prices $100/bbl) compared to the $1-$8/bbl back in 1999 (when oil prices were $9/bbl).

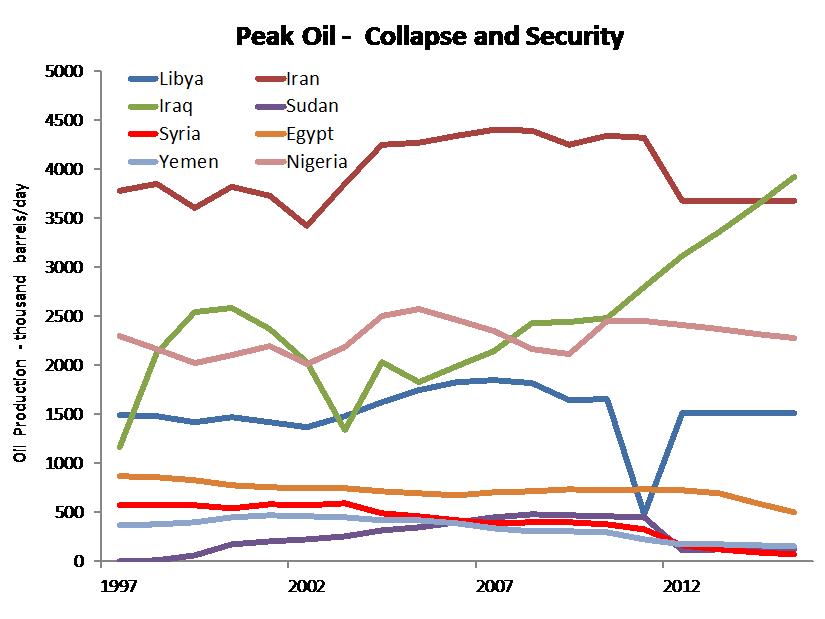

Oil production has collapsed in some of the more unstable countries - lack of oil revenues and expanding populations have caused economic hardship - which has help trigger regimes collapsing and low oil production as fighting-security issues pervade.

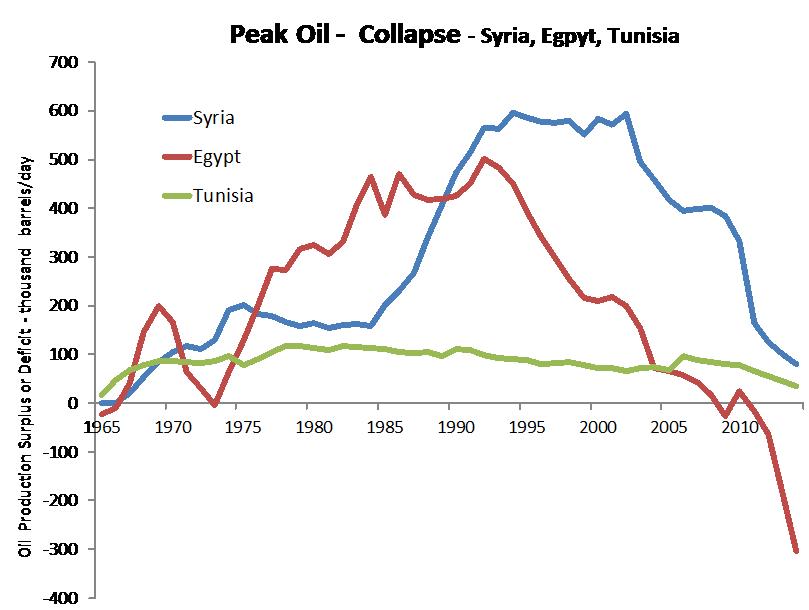

Peak oil collapse - in Syria, Egypt and Tunisia - has in our view help trigger the regime change as food and fuel prices were forced up and social spending collapsed - as oil exports declined. Getting used to cheap oil (the "punch bowl" that is then taken away) might be worse than having none in the first place ("dry party").

African oil production is unstable and appears to be in decline.